Model Definition

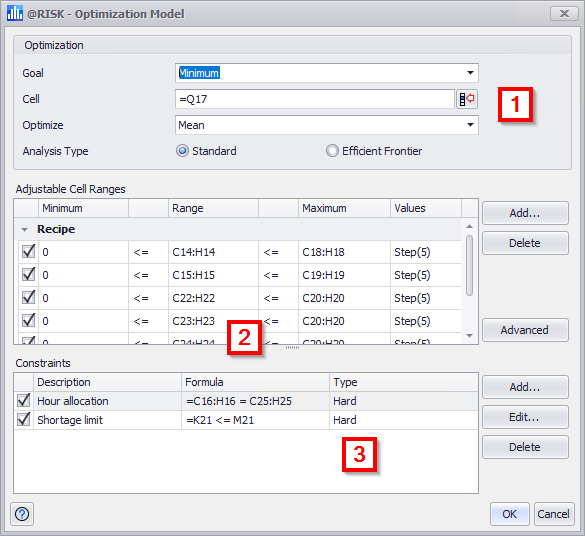

The Model Definition window (Figure 1, below) provides an interface for defining a RISKOptimizer model, including its objectives, adjustable cells, and constraints.

Figure 1 - RISKOptimizer - Model Window

RISKOptimizer Model Window

The RISKOptimizer Model window consists of the following primary components:

- Optimization Configuration

- Adjustable Cell Ranges

- Constraints

Optimization Configuration

The top section of the window includes three options that specify the optimization’s objective. These configurations are: