RiskBMMR

|

Description

|

RiskBMMR Unlike standard Brownian Motion, a mean reverting model will tend toward a long-run equilibrium mean. When the series is above this level, it will tend to decrease, and vice versa. The parameter This process was originally proposed by Vasicek in 1977 as a model for interest rates. It is typically not a good model for stock prices because there is typically no reason to believe that stock prices revert to some long-term mean. However, interest rates cannot rise indefinitely because of economic forces; they tend to revert back to some long-term mean value.

|

|

Examples

|

RiskBMMR(0.01, 0.05, 0.2, 0.015) generates a mean reverting Brownian motion process with long-term mean 1%, volatility 5%, speed of reversion rate 0.2, and value 1.5% at time 0. RiskBMMR(C10, C11, C12, C13) generates a mean reverting Brownian motion process with parameters taken from cells C10 to C13. |

|

Technical Details |

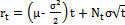

Define Then for any

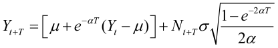

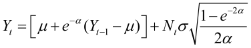

The discrete equivalent of this is

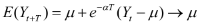

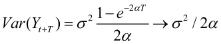

The conditional mean and variance of

|

,

,  ,

,

,

,